Unleash the Power: Introducing the 2018 Chevrolet Camaro 1LT Bumblebee at Toyo Financial Group in Cypress, TX

February 7, 2024

Welcome to Toyo Financial Group Blog: Your Key to BHPH and Easy Financing in Cypress, TX Looks inside of 2019 Genesis G80 3.8L

February 12, 2024

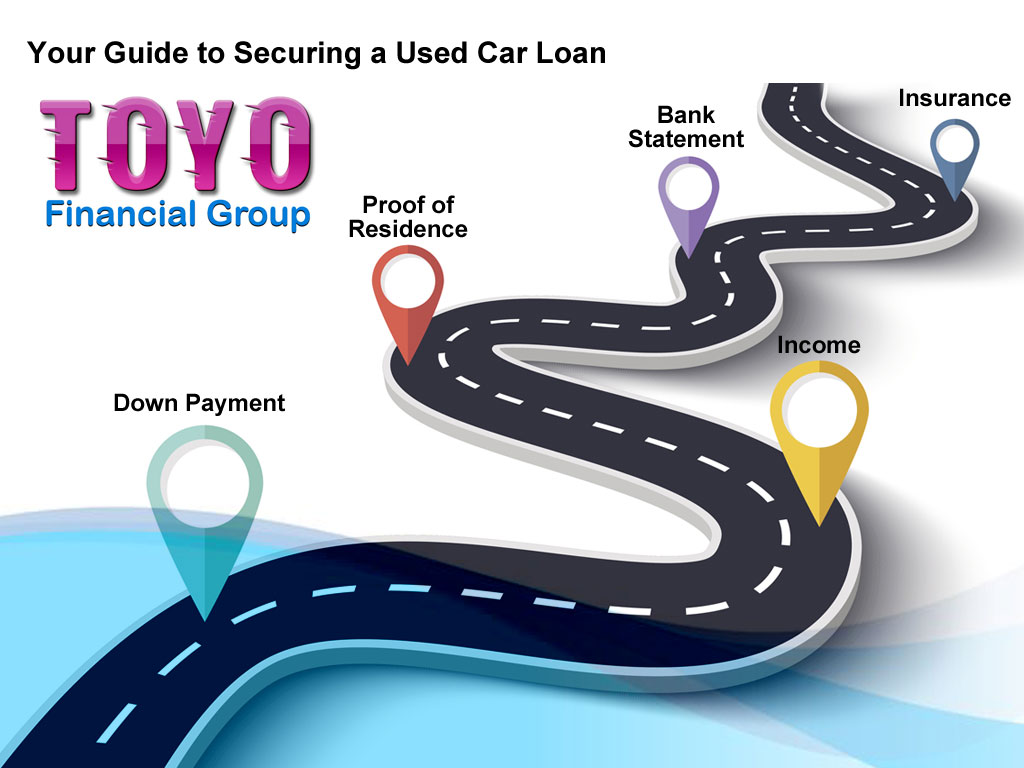

At Toyo Financial Group, we understand that purchasing a used car can be a significant investment, and obtaining a loan approval is a crucial step in the process. In this blog post, we’ll walk you through what you need to know to secure a loan for a used car and how you can use this opportunity to build your credit score.

1. Documentation Needed for Loan Approval:

When applying for a used car loan with Toyo Financial Group, there are several pieces of documentation you’ll need to provide to streamline the approval process:

- Proof of Identity: This typically includes a valid driver’s license or state ID.

- Proof of Income: We’ll need to verify your ability to repay the loan, so documents such as pay stubs or tax returns can be helpful.

- Proof of Residence: This can be a utility bill or lease agreement that confirms your current address.

- Vehicle Information: Details about the car you’re purchasing, including VIN, make, model, and mileage.

By having these documents ready when you apply for a loan, you can expedite the approval process and get behind the wheel of your dream car sooner.

2. Securing a Loan for a Used Car:

Toyo Financial Group offers competitive financing options for used cars, making it easier for our customers to find the right vehicle within their budget. Our experienced team will work with you to customize a loan solution that fits your financial needs and preferences.

Here are some benefits of choosing Toyo Financial Group for your used car loan:

- Flexible Terms: We offer flexible loan terms to accommodate your budget and financial goals.

- Competitive Rates: Our competitive interest rates ensure that you get the best possible deal on your loan.

- Quick Approval Process: With our streamlined application process, you can get approved for a loan quickly and hassle-free.

- Excellent Customer Service: Our dedicated team is committed to providing exceptional customer service every step of the way.

3. Building Credit with Toyo Financial Group:

Taking out a loan for a used car is not only a convenient way to finance your purchase but also an opportunity to build or improve your credit score. Here’s how you can make the most of this opportunity:

- Make Timely Payments: Paying your loan installments on time is one of the most effective ways to boost your credit score.

- Keep Your Credit Utilization Low: Aim to keep your outstanding debt relative to your credit limit low, as this can positively impact your credit score.

- Monitor Your Credit Report: Regularly review your credit report to ensure that all information is accurate and up-to-date. Report any errors or discrepancies promptly.

- Diversify Your Credit: Having a mix of different types of credit, such as loans and credit cards, can demonstrate your ability to manage various financial obligations responsibly.

At Toyo Financial Group, we’re committed to helping our customers achieve their financial goals. Whether you’re looking to finance a used car or improve your credit score, we’re here to support you every step of the way.

If you have any questions or would like to learn more about our loan options, feel free to contact us or visit our dealership in Cypress, TX. We look forward to assisting you with your automotive and financial needs!

Sincerely,

Ben Gholizadeh

Toyo Financial Group